04 Jun

How to Price your Startup Product

How are software prices determined? You have a new startup product and SaaS company! Congratulations, how are you going to price the product? Pricing is based on research and data – not opinion or passion. To have a sustainable business you’ll need to make money.

This presentation was originally provided to the WTIA Cohort Program.

Is pricing an art or a science?

I suppose pricing your new startup product is a little bit of both, but there are some common mistakes that startups make pricing their product. The most important is that you don’t price the product to low. The best prices keep you in business.

How do you determine the right pricing for your product? The price of your product needs to cover three expenses:

- The cost to build your startup product or service

- The cost to sell – marketing, promotions, sales, business development

- The reasonable to exceptional profit that you will have leftover after you have happy customers!

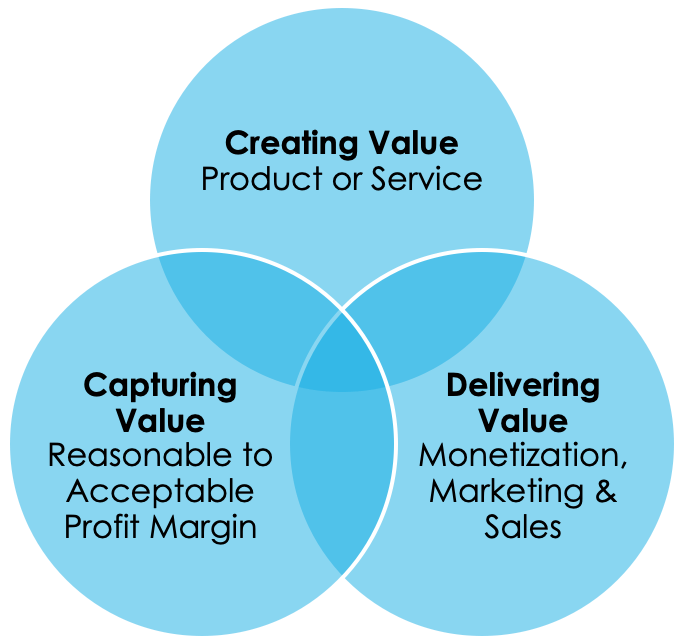

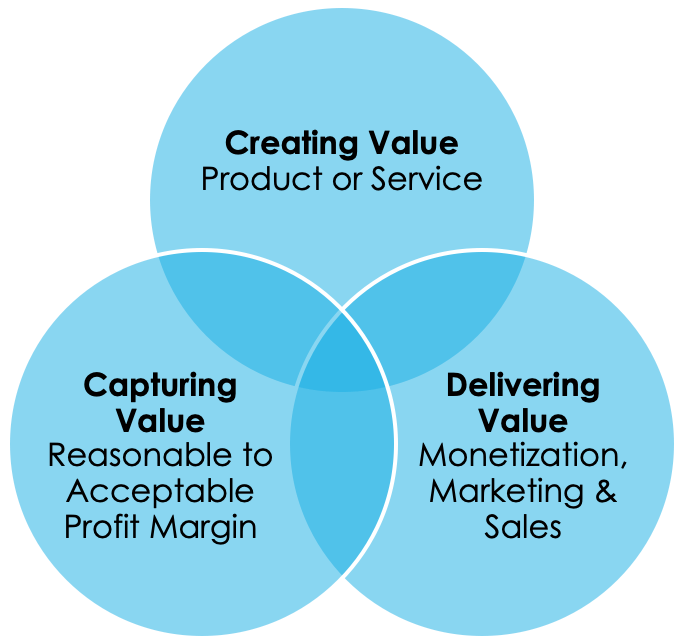

These represent the three components of a startup business model:

- Creating Value – how much capital is required to create your product or deliver your service

- Delivering Value is the method you will use to market your product(s), the model you will use to sell your product, the expense to deliver and the revenue model you will use to monetize your product

- Capturing Value is the profit you have left at the end. If your gross margins are great you’ll find an investor. If they are “meh” it’s going to be a struggle

A lot of products have been created, some amazingly cool products in fact, that were never able to capture value from their clients.

Pick a Revenue Model

Or two, the list below is from 16 Revenue Model Overview and slide presentation. More than an Example of Revenue Models, it’s a list of revenue models. Go to that post for a more detailed breakdown of the models.

- Fee for service – when people are required to deliver your product or service. Th

- Commerce – the sales of a product, think Amazon. It could be a product that you make, but also just a product that you sell.

- Subscription – SaaS startups have a history in magazine subscription was an example of a revenue model or revenue stream. This model is now the standard for recurring revenue businesses, software as a service (SaaS) – think Salesforce.com and Spotify

- Productize a service – this is where you charge a flat fee for a product/service that is delivered by people – however, the cost of delivery is brought down over time with tools and software. Moz would be an example of a business that started as a services company and migrated to a subscription company.

- Transaction Fee and/or Rental – Chugg is a great example of a rental company and Kickstarter is in the business of taking a transaction fee for providing their platform.

- Lead Generation – is where marketers are better at acquiring web traffic cheaper than the lead buyers. Think Mint.com and CreditCards.com – they aggregate traffic and sell those leads at a premium.

- Gaming – is in the enterprise of selling fun, not necessarily solving a problem. Pay to download was the old model and overall the trend is toward in-app purchases.

- Marketplaces – are connectors of buyers and sellers for a transaction fee. Uber’s model is a marketplace (at launch) as are other “gig-economy” companies. Like eBay, marketplaces don’t typically “own” their inventory and are distinct in that they have two customer acquisition funnels of buyers and sellers.

- Advertising/Search – Google and Facebook are great examples of the Advertising and Search Revenue stream or revenue model. If you get the product for free, you’re the product! This model only works at scale however, so plan how you’re going to make money before you get to 1M unique users visiting your site monthly.

- New Media – is the model that is referred to as “going viral” and is really a placeholder for a future advertising model. Think WhatsApp and Facebook, they have a viral coefficient of >2 users signing up for every paid user you bring in as a paying customer. This model is great because of its Network Effect. However, it doesn’t work in B2B enterprise markets

- Combinations – take two (usually) models in combination – this is difficult when you launch your product because you don’t usually have many options – however you can be a service + subscription or a transaction fee + subscription fee. An example of this revenue model at both the launch and scale stage is SmartSheet. They do customer setup/integrations for large customers. This brings in profitable revenue and shortens the sales cycle to onboard new clients.

- Coins/Tokens – the jury is still out as we evaluate cryptocurrencies’ long term participation on this list.

- Multi-sided marketplaces – TheRealReal is an example of a three-sided marketplace. Stay away from this model if you can at the launch stage of your startup, the level of complexity compounds the risk of being successful.

- Big Data – if you have big data you can definitely sell it! However, if you’re getting ready to launch your startup and don’t yet have the data it could easily take you 18-36 months to capture enough data to sell. PatientsLikeMe is an example of aggregating (and anonymizing) source data of patients to large pharma companies.

- Panels – Taluna is a company that will create a panel if “100 IT Directors at Fortune 500 companies. Again, a viable revenue stream for a company at scale, but painfully hard at launch without a list to sell to your customer.

- Licensing – I mention licensing as the final model, not because it’s no longer viable, it’s simply in decline. 20 years ago when I started my first company in the Microsoft ecosystem all of their software was sold as a license. I also remember the transition stage from license to subscription and the “gnashing of teeth” at the time. Now it’s nearly all subscriptions.

Product Pricing Mechanics

If you know your cost basis, pricing can be much easier. Often early-stage startups are trying to build their MVP in advance of building a full-featured product. so the early days are all full of costs to build. The goal is to recoup the expenses as you bring on new customers who pay for the product over time.

Cost-based pricing

This is typically a markup model where you know your costs. The easiest example is where you have people delivering a service.

Let’s say you’re employing a group of developers to work on a project for a customer. It’s a time and materials contract vs. a project with a scope document and fixed bid. In that case, you are going to have:

- Pay Rate, the hourly rate of $50 an hour

- Bill Rate, is what you charge the customer to provide the staff, for simplicity, we’ll go with $100

- This leaves you with a Gross Margin of $50. $50 / 100 = 50%

- After you take away your cost of sales for the project you’ll be left with your net-margin

Pricing complexity goes up from there with Cost of Goods Sold or COGS. If our example was a restaurant, you would take the revenue from the sales, subtract the labor expense and the COGS (the food costs) to get your gross margins.

This is the bottom-up model of pricing.

Value-Based Pricing

Value-based pricing represents the range of prices that you could charge for the product – or the top-down approach. At the time I’m writing this post/book Toyota is releasing its new Supra. The retail price point on the car is ~$55k. But because of scarcity, there is a dealer in the news offering a “No Haggle Price of $167,000. Glad it’s no haggle, that would be stressful!

What can the market bear for your product and price? That’s tougher to determine than just a cost-based model. The answer to that question starts with the competition and what Clayton Christian called the “Jobs to be Done” framework.

Market Triangulation

Finding the market pricing for your product is a research exercise in looking at the current and past pricing of your competitors. The most obvious place to look for competitive pricing is your direct and indirect competitors’ websites.

But you can go a couple of steps deeper and use the Wayback Machine, aka the internet archive to look at historically cached pages of your competitors. Not only can you see historical pricing. You can dig in on product features and positioning of their marketing. This is a good place to look for their go-to-market strategy and tactics as well.

Still can’t find the pricing data you’re looking for? I’d take the question to Quora, the Q&A site. There’s even a group with 174k followers called Pricing. My guess is if you ask, you’ll find a former employee or customer willing to tell you the price of Pitchbook’s annual subscription and how many seats you’ll get for that annual fee.

Jobs to be Done Framework

The “Jobs to be Done” takes a little more explanation. From the HBR post by Clayton Christensen

“Job” is shorthand for what an individual really seeks to accomplish in a given circumstance.

But this goal usually involves more than just a straightforward task; consider the experience a person is trying to create. What the condo buyers sought was to transition into a new life, in the specific circumstance of downsizing—which is completely different from the circumstance of buying a first home.

The circumstances are more important than customer characteristics, product attributes, new technologies, or trends.

Before they understood the underlying job, the developers focused on trying to make the condo units ideal. But when they saw innovation through the lens of the customers’ circumstances, the competitive playing field looked totally different. For example, the new condos were competing not against other new condos but against the idea of no move at all.

Good innovations solve problems that formerly had only inadequate solutions—or no solution.

Prospective condo buyers were looking for simpler lives without the hassles of homeownership. But to get that, they thought, they had to endure the stress of selling their current homes, wading through exhausting choices about what to keep. Or they could stay where they were, even though that solution would become increasingly imperfect as they aged. It was only when given a third option that addressed all the relevant criteria that shoppers became buyers.

What’s your hypothesis?

You need a product pricing strategy from the start. Pricing isn’t an afterthought. You need to have a pricing hypothesis from the beginning of your company. If you haven’t so far, it’s not too late to get started now. Pricing is a critical component of your financial template.

- Pick a model – monthly, annually, transaction fee, etc

- Do the research

- Look at your cost structure

- Pick a pricing range

A/B Testing

With your research in hand, you’re going to start doing A/B testing exclusively to price your product.

- Setup Google Analytics on your website if you haven’t already

- Pick your choice of A/B testing tools from HubSpot’s list of the 8 best testing tools. Or you can simply use the less expensive Unbounce product, $79 month with a 14-day trial

- To make this test viable, you’re going to need traffic that is regularly looking for your price info today – if it’s from your main site or traffic you can purchase from Adword or social media

- If you’re too early for traffic but want to start testing your idea, subscribe to Launchrock.com and use it to test landing pages.

You’ll be using a “squeeze” page to test your landing pages. this is a page that has no navigation other than “check out.” It’s the same functionality that Amazon uses at checkout. You either have to type in a URL or in their case, hit the back button.

Promotions

Finally, you need to recognize that you may start with low prices, but it’s really difficult to raise prices without significant product improvements.

For that reason, you should choose promotions as an additional variable to test your pricing. Again, this is a testing mechanic to find the right offer for the right customer at the right stage of your product and company.

- Freemium – usually a defeatured product (which can be difficult early on) and generally B2C vs B2B (it’s hard to defeature an enterprise product from the MVP and retain customers)

- The time-based trial is the B2B equivalent of freemium – 90 days free.

- Early adopter based – first 50 users

- Percentage Discount – keep the full price on board but offer a discount on annual purchase

- Grandfather in early users – they are going to put up with the rough early product, you may want to keep them at the discounted price

Stuart Marshall

Thanks for posting the slides.

One thing I’ve been thinking about recently is that organizations can very much do inbound and outbound at the same time. It’s possible to do a self-serve model that casts a wide net and catches many small fish, and at the same time have outbound sales to find and land the big fish.