What Do I Actually Do As My Startup Unravels? 6 Actions To Do Now!

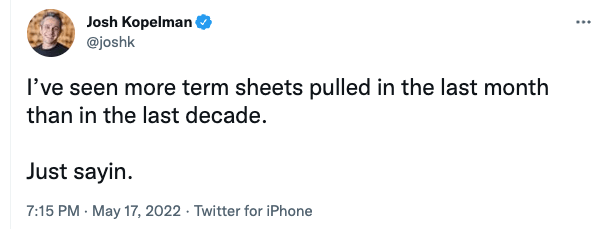

Pulled Term Sheets, pending recession, a self-fulfilling prophecy, investors who aren’t coming through, or have you just plain waited too long to trim your expenses? It doesn’t matter which reason, what matters is – what are you going to do about it and where do you start when things start to unravel?

1. Stop wishing! Hope has a reason, wishing does not. If the investor who made a commitment to fund your startup two months ago (still hasn’t), they aren’t likely to fund when you’re 60-90 days away from being out of cash! Is that “right?” Who cares, it’s time to take the reigns and not worry about that investor or market conditions. Control what’s in your control! Termsheets are non-binding and can/will change.

2. Get a handle on weekly cash. Not monthly, not quarterly… what’s in the bank account today, what cash will come in this week, what cash will go out. Get it into a spreadsheet on your desktop, and track it every day. It doesn’t matter that you don’t have a CFO, no one needs to do this exercise. Where can you get your customers to pay faster? Where can you slow down payments? Call your vendors and let them know, and communicate clearly with transparency. Don’t hide, that won’t make it any easier.

3. Start your lifeboat drill. You have limited seats in the lifeboat. Cut deep, not twice. Based on current salaries and fully burdened expenses, what do you need to do to limit expenses and cut your burn rate? If you can pay them for two weeks or four weeks, that’s awesome and you should. It’s better to do that now than wait two weeks before you do the layoff. Again, no wishing!

4. Make the reductions in staff today! I know it’s hard, I know you don’t want to. Yes, you told them they were “family” but, you were wrong. You’re not a family, you’re a sports team. When you need to go into a rebuilding year, you do.

5. Keep the hustle! You need to keep selling. If you need to sell services in the near term, do it. It’s not your ideal revenue, but at least it’s revenue and will keep your team employed. Do promotions to come off your regular pricing and get deals closed. Sell annual contracts – only if, in good faith, you’ll be able to deliver on the contract.

6. Keep investing in the activities that have a clear path to return on investment. Firing your salesperson (if they are closing) isn’t a good idea and can send you into a final death spiral. The same is true with marketing. Keep a focus on revenue and cut expenses. If you can’t get revenue with the product you have today, you have a different issue.

Desperate people do desperate things – that doesn’t justify a bad decision. Make good decisions, and think about the long-term implications of the decisions you’re making today. Talk to your investors. They may not put more money into your deal, but they may be able to help with advice.

Remember, you need to survive the downturn (real or imagined) to have a successful exit and prove the investor the bailed on your wrong.

P.S #Investors, if you’ve made a commitment. Yes, the market is shaky. Yes, things have changed, but you’ll be remembered later. Founders talk just like investors talk. What Can You Do if a VC Pulls Their Term Sheet? If you’re a non-lead investor that’s made a commitment to fund, and you’re dragging your feet because of market condidtions, be honest with the founder. Make a decision, leading them on is not your best option.