What Valuation is Right for Fundraising or Selling?

The more mature your company has grown the more data there is to value the business. Early days, you’re valued on potential and market size (TAM) vs financial metrics.

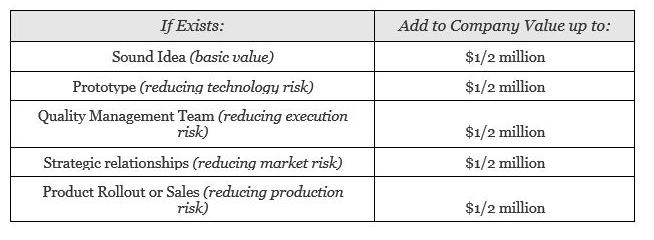

For early-stage venture-backed, pre-revenue companies, one of the methods is the Berkus Method. Dave Berkus is a Super Angel based in the LA, CA area. The original model was done in the ’90s and updated regularly for the last 20 years.

Here’s a post on the Scorecard Method, VC Method, and the Berkus Method. It places earned value on five factors, outlined below.

But as the company matures, you have real data to make a valuation. It just might not be the valuation you want! If you have a strong forecast (as in you’re regularly hitting the forecast) you can trade on a future 12 valuation vs a trailing 12. If you’re growing quickly or have high margins that is a plus. But if momentum has shifted to flat or still growing, but not as fast, your valuation will be going down.

The single largest factor in valuation is creating competition. If you’re not running a process to create multiple buyers you’re likely leaving money on the table. Start with the anchor offer first and build from there.

Want to learn more about selling your company in the next 12 months? Join us today, Wednesday July 15 at 11am Pacific Time.